When it comes to investing in ETFs there are plenty of brokers to choose from. While you have probably heard about Vanguard and Fidelity or some of the lesser known but still popular investment broker companies such as Hargreaves Lansdown or Interactive Investor you might not have heard about Invest Engine (currently only available to UK residents).

What are ETFs?

An ETF (exchange-traded fund) is an index fund which tracks a group of stocks, bonds, currencies, debts, futures contracts and/or commodities such as gold or silver for a diversified capture of a market or industry. Index funds are a good way to invest in securities while reducing risk and volatility – especially over a longer time frame when one wants to set “set and forget” their investment while feeling confident that their investment will perform well.

Why choose Invest Engine over the more reputable competition?

The first thing that might come to mind is why you should choose Invest Engine over the competition? The main reason is that Invest Engine offers less fees which means as your investments grow you will keep more money. The other major persuader is that Invest Engine has a modern user interface with easy rebalancing and a large selection of ETFs to choose from (150+).

Invest Engine Fees

When opening an ISA account with Invest Engine the fees are 0% if you choose to build a DIY portfolio. The alternative is that you can let Invest Engine manage your portfolio for you based on your risk tolerance in which their fees are 0.25%.

It should be noted that each index fund has its own fees but this is not a dealing fee and Invest Engine makes nothing from this fee. This fee goes to the company that manages the fund for instance BlackRock or Vanguard.

Auto Rebalancing

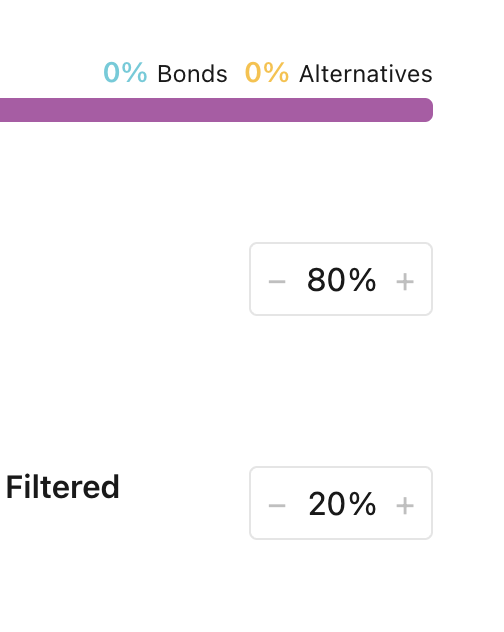

Auto-rebalancing is a helpful feature found on Invest Engine. You set the weights in terms of percentages in a portfolio and Invest Engine will allocate your funds proportionally any time you make a deposit. This can save time compared to doing the maths with regards to share prices and then the time needed to make individual purchases.

Fractional Shares

Invest Engine allows you to purchase fractional shares – this can be helpful to use the full amount you allocated towards a portfolio. Say you invest £800, but the share price is £500, then on platforms that have such rules you could only buy 1 share leaving you with £300 not allocated towards a fund. You could of course withdraw this or not deposit such amount in the first place but this is impractical and inefficient if you have an investing plan in mind.

Regulations

It is important to make sure when investing that the company you are using is authorised and offers some sort of protection incase things go wrong. Luckily Invest Engine is authorised and regulated by the Financial Conduct Authority (FCA) and covered by the Financial Services Compensation Scheme (FSCS).

We will also point out that if Invest Engine was to go bankrupt your investments are ring-fenced and would be transferable to another broker. As a broker, Invest Engine does not touch your investments.

Requirements

There are no requirements to sign up with Invest Engine but you must be aged 18 or older and be a resident of the United Kingdom. You will need to verify your details upon registration before your account is approved.

Final Thoughts

We recommend Invest Engine if you are looking for an ETF broker that is easy to use and has lots of benefits, but because of its infancy, we cannot recommend this broker for high net worth investors at this stage. While there is protection in place, for peace of mind, we wouldn’t invest a large fraction of your portfolio.