The rapid growth of cryptocurrencies has made finding the best cryptocurrency platforms in the UK essential for both novice and experienced investors. Platforms such as eToro, Coinbase, and Kraken stand out with their user-friendly interfaces, robust security measures, and diverse cryptocurrency offerings. These exchanges cater to varying needs, whether one seeks to invest in Bitcoin, explore altcoins, or make use of advanced trading features.

In an ever-evolving market, the right exchange can significantly influence investing success. Popular options provide competitive fees, easy cryptocurrency purchases, and reliable customer support, making the trading experience seamless. Investors must consider their specific requirements, including security, ease of use, and available trading tools, when choosing a platform.

As the demand for digital currencies continues to rise, being well-informed about the best cryptocurrency platforms in the UK becomes crucial. Whether making the first investment or managing a diverse portfolio, selecting the right exchange can pave the way to a successful crypto journey.

Choosing the Right Cryptocurrency Exchange

Selecting the appropriate cryptocurrency exchange is crucial for a successful trading experience. Key aspects to consider include the exchange’s features, security measures, and the quality of customer support available.

Key Features to Consider

When assessing a cryptocurrency exchange, users should look for essential features such as fees, transaction limits, and the variety of cryptocurrencies offered. Exchanges may have different fee structures, including trading fees, withdrawal fees, and deposit fees.

Additionally, a user-friendly interface enhances the trading experience. Advanced features, such as charting tools and real-time analytics, cater to experienced traders. Regulatory compliance with the Financial Conduct Authority (FCA) is vital, as this provides a layer of credibility and supports KYC (Know Your Customer) processes. This compliance helps ensure the exchange operates within legal frameworks, safeguarding users’ investments.

Understanding Security Protocols

Security is one of the most critical considerations when choosing a cryptocurrency exchange. Users should look for exchanges that implement robust security protocols. Two-factor authentication (2FA) is a standard security measure that adds an extra layer of protection to accounts.

It is also important to explore how exchanges store their assets. For instance, exchanges that offer cold storage for the majority of their digital assets reduce exposure to hacks. Regular security audits and transparency regarding security measures enhance user trust.

Furthermore, understanding the insurance policy on funds can also be beneficial. An exchange that provides insurance coverage for funds not only safeguards against potential losses but also promotes user confidence.

The Importance of Customer Support

Quality customer support can significantly enhance the trading experience on a cryptocurrency exchange. Users should evaluate the support options available, such as live chat, email, and phone support. Fast response times are vital for addressing issues that may arise during trading.

Moreover, comprehensive help and FAQ sections can guide users through common challenges. Customer support should be knowledgeable about the platform and familiar with regulatory compliance, ensuring that users receive accurate information. Additionally, exchanges that offer multilingual support can cater to a broader audience, making it easier for users to navigate the platform and resolve any concerns they may encounter.

Popular Cryptocurrency Exchanges in the UK

The UK cryptocurrency market features several popular exchanges that cater to various needs, from user-friendly platforms for beginners to those designed for seasoned traders. Key players in this space include eToro, Coinbase, and Kraken, each offering unique features that appeal to different trading styles.

eToro and the Social Trading Phenomenon (Best for Beginners)

eToro stands out in the cryptocurrency landscape for its innovative social trading features. Users can easily share insights and strategies, allowing novices to learn from experienced traders. This platform supports over 70 cryptocurrencies, enabling a diverse trading experience.

The user-friendly interface simplifies trading for individuals unfamiliar with the crypto market. eToro also offers copy trading, where users can mimic the trades of successful investors, making it ideal for beginners. Additionally, its regulatory status provides an added layer of security. The combination of high trading volume and liquidity enhances the trading experience, making eToro a top choice for those exploring the cryptocurrency space.

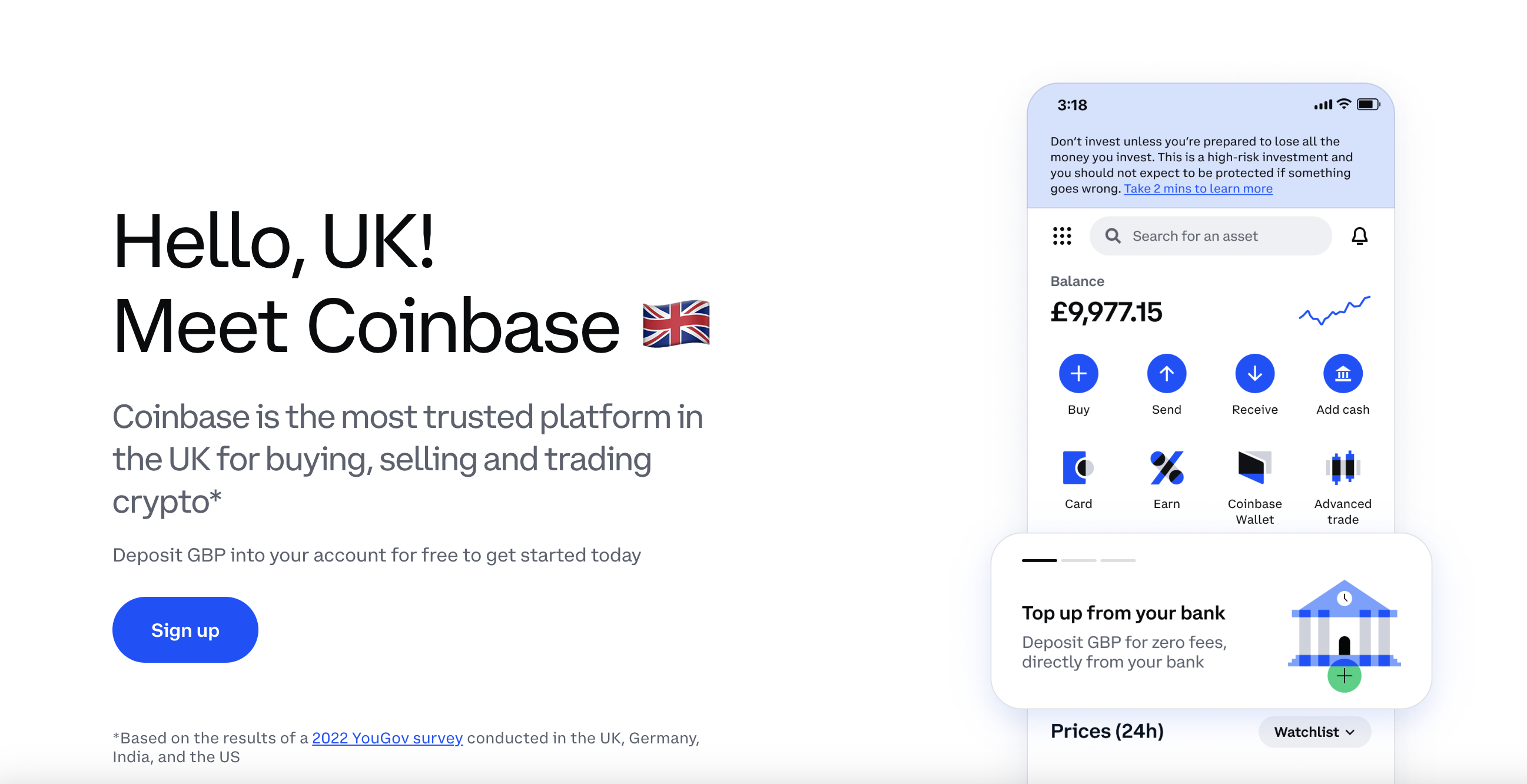

Coinbase: A User-Friendly Gateway to Crypto

Coinbase serves as a leading gateway for cryptocurrency enthusiasts in the UK. Its intuitive interface allows users to buy, sell, and manage a variety of cryptocurrencies seamlessly. Supported cryptocurrencies include popular options like Bitcoin and Ethereum.

Coinbase prioritises security, employing robust measures to protect user assets. The platform is particularly appealing for beginners due to its educational resources and easy onboarding process. Coinbase also features a mobile app for trading on the go, ensuring users can manage their portfolios anytime. Though fees may be higher compared to some competitors, the convenience and user experience often justify the cost, making it a favoured choice among newcomers.

Kraken: Combining Security and Liquidity

Kraken is renowned for its strong security features and high liquidity, catering to professional traders. The exchange supports spot trading for a wide array of cryptocurrencies and is known for its advanced trading options, including margin trading.

With a variety of tools and charts, Kraken provides extensive market insights to help users make informed decisions. The platform also has a reputation for excellent customer support, an essential aspect for traders operating in fluctuating markets. Regularly processing significant trading volumes, Kraken ensures that liquidity is rarely an issue, making it an excellent choice for those seeking a reliable trading experience.

Advanced Cryptocurrency Trading Features

Advanced trading features enhance the trading experience, providing users with various tools and strategies to maximise their investments. Traders can leverage margin and futures trading, explore decentralised exchanges, and utilise algorithmic trading and trading bots to streamline their operations.

Margin and Futures Trading

Margin trading involves borrowing funds to increase the potential size of a trading position. It allows traders to amplify gains, but also heightens risk. Most cryptocurrency platforms offer leverage that ranges from 2x to 100x. Traders should understand the implications, including the potential for margin calls and liquidation of positions.

Futures trading allows users to buy or sell cryptocurrencies at a predetermined price at a future date. This feature can be beneficial for hedging against market volatility. Traders can speculate on future price movements without owning the underlying asset. It is crucial for traders to develop robust strategies to navigate the risks associated with these advanced features.

Decentralized Exchanges and Their Ecosystem

Decentralised exchanges (DEXs) operate without a central authority, enabling peer-to-peer trading. They facilitate secure transactions directly between users, promoting privacy and access to a wider range of cryptocurrencies. DEXs often employ automated market-making (AMM) protocols to ensure liquidity.

The ecosystem surrounding DEXs continues to evolve, with various token incentives and yield farming options available. Users can earn rewards by providing liquidity, but they must also consider the potential for impermanent loss. Understanding these concepts is essential for making informed decisions when trading on decentralised platforms.

Algorithmic Trading and Trading Bots

Algorithmic trading utilises complex algorithms to automate trading strategies, minimising human error and optimising execution. These systems can analyse market data and execute trades at high speeds, which is essential in the highly volatile cryptocurrency market. Traders can configure bots to follow specific strategies, such as market-making or arbitrage.

Trading bots can operate 24/7, enabling traders to capitalise on market fluctuations even when they are not actively monitoring their accounts. Selecting a reliable platform that supports these advanced features is vital, as bot performance can significantly impact trading results. Understanding the capabilities of various bots helps traders align them with their trading objectives.

Facilitating Transactions and Asset Management

Efficient transaction facilitation and effective asset management are crucial for users engaging with cryptocurrency platforms. This involves a variety of payment options, secure withdrawal processes, and the use of wallets for storing digital assets. The following sections provide detailed insights into these components.

Payment and Withdrawal Options

Users can access multiple payment methods to fund their accounts, including bank transfers, credit cards, and e-wallets. Known platforms like eToro and Coinbase often support these options. It’s important to examine the minimum deposit requirements and whether any additional fees apply for transactions.

Withdrawal processes can vary significantly between platforms. Some exchanges impose withdrawal fees, which users need to consider when planning transfers. Moreover, the duration of transaction processing can differ. For instance, some platforms may execute withdrawals almost instantly, while others might require days. In the context of regulatory compliance, anti-money laundering (AML) measures also play a vital role, ensuring that transactions meet legal standards.

Crypto Wallets and Cold Storage Solutions

Selecting a suitable crypto wallet is essential for secure asset management. Users can choose between hot wallets (online) and cold storage options (offline). Hot wallets, while convenient for frequent trading, may involve higher risks due to constant online exposure.

Conversely, cold storage solutions provide enhanced security, often using hardware or paper wallets to protect assets. Platforms like Kraken offer dedicated wallets, with some enabling features like staking for enhanced portfolio growth. It is advisable for users to understand the specifics of each wallet type, including security measures and compatibility with different cryptocurrencies, ensuring their assets remain safe and accessible.

Compliance, Security, and the UK Regulatory Environment

The UK’s regulatory environment for cryptocurrency platforms is evolving, primarily overseen by the Financial Conduct Authority (FCA). They enforce compliance with anti-money laundering (AML) regulations and require platforms to adhere to strict Know Your Customer (KYC) processes.

Key Compliance Requirements:

- Registration with the FCA

- Implementation of robust KYC processes

- Regular reporting of suspicious activities

Cryptocurrency exchanges must employ robust security measures to protect user funds and data. This involves encryption, two-factor authentication, and regular security audits. Compliance with these regulations is essential for maintaining trust in the marketplace.

Tax obligations are another crucial aspect. Cryptocurrency transactions are subject to UK tax law, and traders must report their activities accordingly. Failure to comply can result in hefty penalties.

Additionally, the FCA has proposed a framework for the regulation of stablecoins. Firms interested in issuing stablecoins will need authorisation, ensuring they meet all regulatory standards.

As the industry matures, platforms that prioritise compliance and security will likely emerge as leaders. They can provide a safer environment for users while navigating the complexities of the regulatory landscape.