Investing wisely is essential for building wealth and achieving financial goals.

The key to successful investing lies in understanding one’s financial situation, risk tolerance, and long-term and short-term objectives.

With numerous options available, individuals can choose from stocks, bonds, mutual funds, or real estate, each offering different levels of risk and potential returns.

A well-thought-out investment strategy can align one’s portfolio with their specific goals.

Individuals looking to grow their money over time might favour equities, while those seeking stability might consider government bonds.

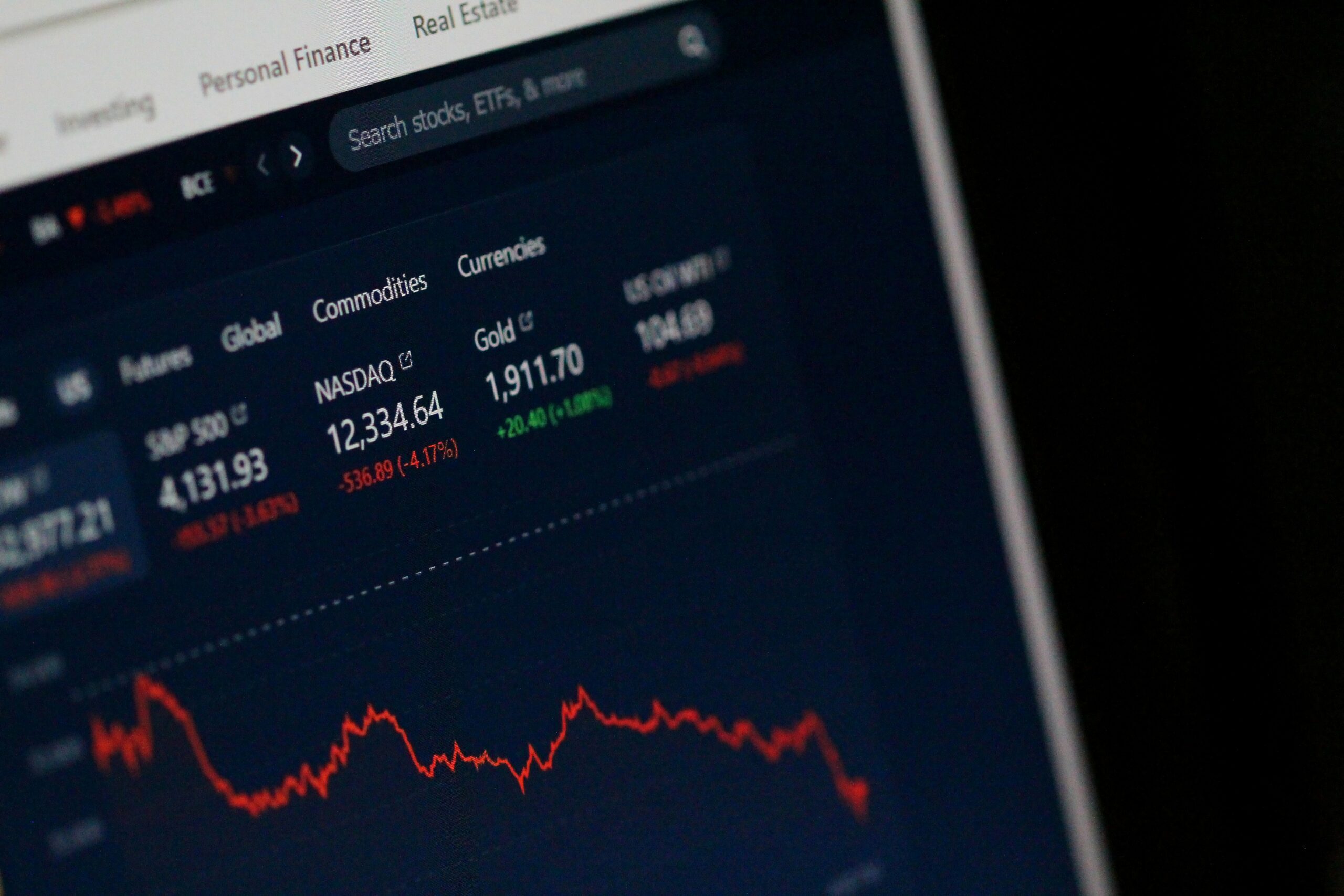

Understanding the relationship between risk and reward is crucial; investing in higher-risk assets may yield greater returns, but also exposes investors to potential losses.

Regardless of the chosen investment path, the importance of regular reviews and adjustments cannot be overstated.

As financial situations and goals evolve, so too should investment approaches, ensuring that assets remain aligned with one’s aspirations and risk appetite.

Understanding Investment Basics

Investing involves navigating various elements that influence how and where funds can be efficiently allocated.

Key factors include the types of investments available, the impact of inflation on returns, and an individual’s risk appetite. Each plays a crucial role in shaping an effective investment strategy.

Types of Investments

Investors have multiple options to consider across various asset classes. The most common types include stocks, bonds, mutual funds, and exchange-traded funds (ETFs).

- Stocks represent ownership in a company, offering the potential for high returns through price appreciation and dividends.

- Bonds are debt instruments where investors loan money to entities in exchange for periodic interest payments.

- Funds pool resources from multiple investors, providing diversified exposure to securities.

- ETFs mimic the performance of an index and trade on exchanges like stocks, combining accessibility with diversification.

Each investment vehicle carries its own risk and returns, making it essential for investors to choose based on their financial goals.

The Role of Inflation

Inflation erodes purchasing power over time, influencing investment performance. It represents the rate at which the general level of prices for goods and services rises.

- For instance, if inflation is 3% annually, an investment return of 5% results in a real return of only 2%.

- Therefore, investors must aim for returns that outpace inflation to preserve wealth.

Strategies to mitigate the effects of inflation include investing in stocks or real assets like commodities, which have historically provided a hedge during inflationary periods.

Determining Risk Appetite

Understanding risk appetite is vital for successful investing. It refers to the level of investment risk an individual is willing to accept.

- Factors influencing this include age, financial situation, and investment goals.

- Younger investors might pursue higher risks for potentially greater long-term rewards through stocks or ETFs, while those nearing retirement may prefer safer investments like bonds.

Diversification is a key strategy to manage risk, spreading investments across various asset classes to reduce exposure to any single investment’s volatility.

Setting Up Your Investment Account

Setting up an investment account is a crucial step for anyone looking to grow their wealth. The right choice can significantly impact investment success.

Key considerations include the selection of a bank or broker, understanding the differences between online brokers and robo-advisors, and ensuring financial stability through an emergency fund.

Choosing the Right Bank or Broker

Selecting the appropriate bank or broker requires careful research. Investors need to consider factors such as fees, service quality, available investment options, and user experience of their platform.

- Fees: Look for competitive brokerage fees and understand any hidden charges.

- Investment Options: Ensure the institution offers a variety of accounts, including IRA, Roth IRA, and taxable accounts.

- Customer Support: Evaluate the availability of customer service and support channels.

An investment account set up with a reputable bank or broker can make managing investments smoother and more organised.

Online Brokers vs Robo-Advisors

Investors can choose between online brokers and robo-advisors based on their preferences and investment goals.

Online Brokers:

- Provide access to a wide range of investment options.

- Offer more control over investment decisions, suited for experienced investors.

Robo-Advisors:

- Utilise algorithms to manage investments automatically.

- Ideal for beginners wanting a hands-off approach to investing.

Both options have merits, with online brokers appealing to those seeking flexibility and robo-advisors catering to individuals preferring automated solutions.

The Importance of an Emergency Fund

Before diving into investments, establishing an emergency fund is essential. This fund provides a financial cushion during unexpected events.

Key Points:

- Recommendation: Aim for three to six months’ worth of living expenses saved in a savings account.

- Purpose: It should be easily accessible and not tied up in investments, ensuring liquidity.

- Peace of Mind: An emergency fund allows investors to manage market fluctuations without panic selling.

Maintaining financial security with an emergency fund safeguards against the uncertainties associated with investing.

Investment Vehicles and Options

Investors have a variety of vehicles and options to consider when deciding where to allocate their funds. Each choice carries its unique characteristics, risks, and potential rewards, catering to different investment strategies and financial goals.

Stocks and Shares

Stocks represent ownership in a company, allowing investors to share in its profits through dividends and capital gains. Investing in individual shares carries higher risks but can also yield significant returns.

Exchange-traded funds (ETFs) and mutual funds provide diversified exposure to a basket of stocks, reducing individual stock risk.

For long-term investing, many individuals use tax-advantaged accounts like a 401(k) to optimise growth while minimising tax liabilities. The UK equivalent includes ISAs, which offer tax-free growth and income.

Bonds and Fixed Income

Bonds are debt securities where investors lend money to governments or corporations in exchange for interest payments and principal return at maturity. They are generally considered lower risk compared to stocks.

Government bonds, including gilts in the UK, are backed by the government, making them relatively safe.

Certificates of Deposit (CDs) are also a fixed-income investment option offering guaranteed returns for a pre-determined period. Investors typically use bonds for capital preservation and stable income.

Funds and Index Funds

Investment funds pool money from multiple investors to purchase a diversified portfolio of assets.

Mutual funds are actively managed by professionals, while index funds aim to replicate the performance of a specific market index.

Index funds typically have lower fees and can be a cost-effective choice for passive investors.

Robo-advisors can assist in setting up and managing portfolios composed of these funds, often making them an accessible option for those new to investing.

Real Estate and Property Investment

Real estate is a tangible asset that can generate rental income and appreciate in value. Direct property investment involves buying residential or commercial properties.

Alternatively, real estate investment trusts (REITs) provide a way to invest in real estate indirectly, allowing investors to benefit from property market performance without managing physical assets.

This sector can be attractive due to its potential for cash flow and inflation protection.

Alternative Investments

Alternative investments encompass a wide array of assets outside traditional stocks and bonds. These can include commodities, art, and private equity.

Investing in art or collectibles can provide diversification but carries unique risks related to valuation and liquidity.

Cryptocurrency has emerged as an alternative asset class, appealing to those willing to accept higher volatility for potentially high returns.

Each alternative investment option requires thorough research and understanding of associated risks before investing.

Strategies for Diversification

Diversification is essential for managing risk and maximising returns in investment portfolios.

Two key strategies for achieving diversification include asset allocation and portfolio management. Both approaches focus on distributing investments across various asset classes to reduce exposure to individual stocks and market volatility.

Asset Allocation

Asset allocation involves distributing investments across different asset classes such as equities, bonds, and commodities. This strategy allows investors to balance risk and reward based on their financial goals and risk tolerance.

Investors often use a model like 60/40 (60% equities and 40% bonds) or other variations to achieve this balance.

Factors to consider include:

- Investment horizon: Longer horizons may favour more equities.

- Risk tolerance: More conservative investors might prefer bonds.

- Market conditions: Adjust allocations based on current economic indicators.

Utilising investment accounts effectively can also enhance diversification. For example, using tax-advantaged accounts can optimise an investor’s strategy.

Portfolio Management

Effective portfolio management is crucial for maintaining a diversified investment strategy.

It involves the ongoing assessment and reallocation of assets to align with an individual’s financial objectives.

Key components of portfolio management include:

- Regular reviews: Assess performance and make adjustments as needed.

- Rebalancing: This involves returning the portfolio to its target asset allocation after market fluctuations.

- Risk assessment: Regularly evaluate individual stocks and asset classes to minimise potential losses.

Managing Your Investments

Effectively managing investments is crucial for maximising returns and minimising losses.

It involves regular monitoring of the investment portfolio, adjusting allocations as necessary, and understanding the fees associated with investments.

Monitoring and Rebalancing

Investors should consistently monitor their investment portfolios to ensure alignment with their financial goals.

This involves tracking returns, assessing capital gains, and evaluating the performance of various assets.

Regular rebalancing is essential to maintain the desired asset allocation.

For example, if stocks have performed well, they may constitute a larger portion of the portfolio than intended.

Rebalancing might involve selling some equities to reinvest in underperforming assets or other options that align with the budget and risk tolerance.

Understanding Fees and Costs

Fees and costs can significantly impact investment returns.

There are various types, including management fees, transaction fees, and fund expenses. Understanding these costs is essential for assessing overall investment profitability.

Management fees are typically charged by fund managers and can erode returns over time.

It’s wise to compare different investment products and their associated fees to maximise profits.

Transaction fees apply to buying and selling assets, which can add up if trading frequently.

Additionally, some investments may offer dividends or interest payments that offset costs. Investors should always be aware of how fees might affect their net returns.

Planning for the Future

Planning for the future is essential for financial security. This involves both strategic retirement planning and a clear understanding of the differences between long-term investments and short-term savings.

Retirement Planning

Retirement planning is crucial for ensuring financial independence in later years.

Individuals should consider various retirement accounts, such as a 403(b), which offers tax advantages for non-profit employees.

To maximise returns, it’s advisable to start early. Compound interest can significantly increase savings over time.

A general rule of thumb is to aim for saving at least 15% of pre-tax income.

Key considerations include:

- Age: Younger individuals can afford to take more risks.

- Risk tolerance: Understanding one’s comfort level can guide investment choices.

- Lifestyle: Projecting future expenses helps determine the necessary savings amount.

Long-Term vs Short-Term Savings

Understanding the distinction between long-term investments and short-term savings is vital.

Long-term investments typically include assets like stocks, bonds, and mutual funds. These are intended to build wealth over time and usually perform better when held for several years.

In contrast, short-term savings focus on liquidity and safety. Savings accounts or money market accounts are useful for immediate needs. They are less risky but often yield lower returns.

Key factors to consider include:

- Time horizon: Long-term investors can ride out market fluctuations.

- Investment goals: Clarity on whether the goal is wealth accumulation or preservation influences the choice of investments.

Seeking Professional Advice

When an individual contemplates where to invest their money, seeking professional advice can be greatly beneficial.

A financial advisor offers expertise in assessing an individual’s financial situation and investment goals.

Consultants provide tailored investment advice, which can help in navigating market complexities.

This guidance is particularly valuable for those with limited experience.

Key benefits of consulting a financial advisor include:

- Customised strategies: Advisors analyse personal financial circumstances to create a unique investment plan.

- Market insights: They stay informed about market trends, helping clients make informed decisions.

- Risk management: Advisors assist in balancing risk with potential returns, ensuring that investments align with one’s risk tolerance.

Individuals may benefit from various types of financial services such as robo-advisors, which combine digital platforms with investment management.

These services are typically easier to access and can suit those comfortable with technology.

When choosing a financial advisor, it is essential to consider factors like:

- Qualifications: Verify the advisor’s credentials and experience in investment advice.

- Fee structure: Understand how they charge for their services, whether it’s commission-based or a flat fee.

- Personal rapport: Finding an advisor with whom one feels comfortable can enhance communication and trust.